The Homewood-Flossmoor Park District got the highest audit rating for its 2015-16 fiscal year that ended April 30, 2016.

Scott Termine, of BKD CPAs and Advisors, told park commissioners that at the completion of the audit, the park district was given a “clean or unmodified opinion. It’s the best you can get under the circumstances” that now shows the full pension liability.

Under new Governmental Accounting Standards Board rules, this year taxing bodies must show pension liabilities. The park district’s net pension liability is $2.8 million, Termine said. In the past, once the park district made its annual contribution to the Illinois Municipal Retirement Fund (IMRF) the audit showed no liability.

The audit shows the park district contributed 12.43 percent or $446,862 toward the pensions of 219 employees – 65 of whom are now collecting a pension.

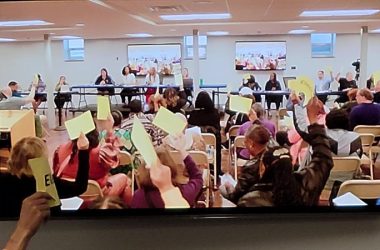

The audit report was presented on Tuesday, Dec. 6, before the commissioners approved an ordinance for the 2016 tax levy of $4,816,177.

Sharon Dangles, superintendent of finance and administration, said she increased the levy from 5 to 6.3 percent in the estimated equalized assessed valuation (EAV) of H-F property after consulting with the Village of Flossmoor.

She raised the number to help the park district capture growth from the new Meijer store on Vollmer Road in Flossmoor. The the Illinois Department of Revenue sets the equalizer/multiplier. That number is then used to establish the EAV for H-F property. The Cook County Assessor’s office allows taxing bodies to set a higher levy in light of a possible decrease by the assessor to meet the state’s tax cap requirement which limits taxing bodies to raise taxes 5 percent or equal to the Consumer Price Index, whichever is less. CPI is currently estimated at .7 percent.

The park board also passed an ordinance instructing the assessor’s office to reduce, if necessary, the IMRF and the social security payment accounts. Both have sufficient balances so reductions will not hurt the funds, Dangles explained. If the district did not give these specific instructions, the assessor would reduce all park district funds.

According to the audit, property-related taxes received during the 2015-16 budget year were $5.10 million compared to $4.97 million in 2014-15. That was a 2.7 percent increase.

Audit information shows a continued drop in property values. The district’s 2015 EAV decreased 3 percent to $515,980,908 from the 2014 EAV of $531,515,849. Despite the reduction, Debbie Kopas, executive director of the park district, said new businesses are signs of a rebound in the H-F area.

(Editor’s Note: This story was edited 12/12/16 to provide correct information related to the Illinois Department of Revenue.)